This report expresses the author’s opinions. The author of this report has a short position in TCMD that will benefit from a decline in the price of TCMD’s securities. A full disclaimer can be found at the end of this report. This is a follow-on to our initial report published in June 2020. If you have not done so already, we strongly encourage you to read it here: link

In our first article, we expressed the opinion that Tactile had significantly overstated its addressable market. Moreover, we presented Medicare RAC audit data showing that RAC auditor Performant Recovery had audited and retroactively denied over 70% of Tactile’s Medicare claims since February 2019. Finally, we also highlighted the existence of a whistleblower lawsuit against Tactile in which the relator alleges the company has knowingly violated the Anti-kickback Statue by providing remuneration to clinicians in the form of training fees. Read on to learn about our new findings below: (link to PDF here)

Summary

Multiple sources of government data suggest a concerning pattern of reporting discrepancies between Tactile’s financial statements and VA and Medicare payment statistics. Backed by hard data, we shed light on what we believe to be revenue recognition practices that mask the increasingly severe repercussions of both the Medicare RAC audits as well as the whistleblower lawsuit.

New documents from the Qui Tam case provide further insight into the inner workings of Tactile’s sales and marketing activity, including witness testimony from former senior regulators attesting to the presence of systemic misconduct covering kickbacks, pre-filled prescriptions, and other false claims. Expert testimony on pre-filled prescriptions is supported by actual documentation sent to us by an industry insider that we believe suggests these practices are systemic across the Tactile organization.

If that is not disturbing enough, discovery documents in a discrimination lawsuit also revealed exorbitantly high rates of prescriber concentration.

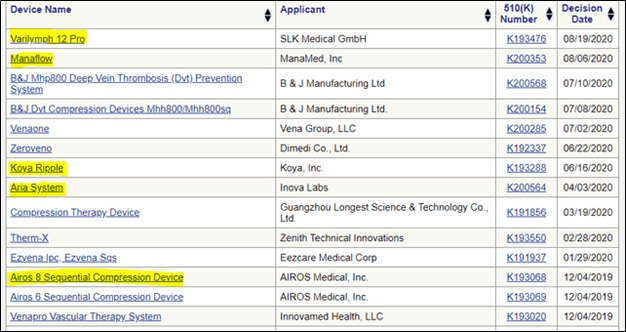

All this while five new reputable and well-capitalized MedTech competitors have recently received 510(k) approval to compete with Tactile—nearly tripling the number of competitors on the playing field.

RAC Audits Appear to be Homing in On Tactile

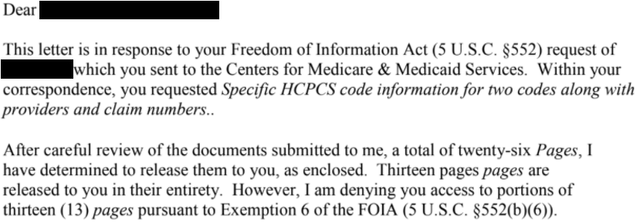

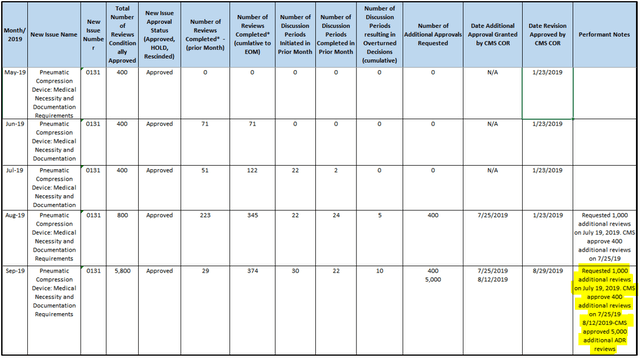

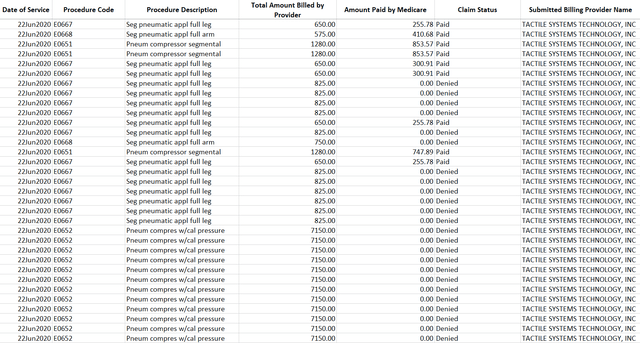

Since our report in June, further FOIA requests via CMS have revealed additional RAC audits targeted at Tactile.

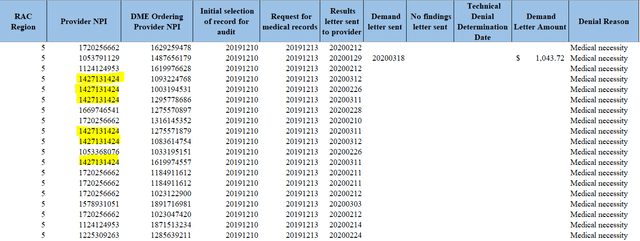

FOIA officers provided a table of all E0651 claims audited over the last year, including dates, denial reasons, and the associated provider. A sample of the raw data we received is shown below, including highlights indicating some of Tactile’s more recent RAC audit denials (Tactile’s NPI code is 1427131424, see here).

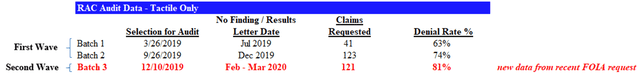

Using this data, we provide a timeline and analysis of the RAC audit results specifically for Tactile below:

According to the FOIA records, Performant requested an additional 121 claims for audit on December 10th, 2019. The results of these audits were disclosed to Tactile over the course of February and March 2020. Our analysis of the data revealed a denial rate of 81%: a further increase from the already sky-high denial rates in previous batches of claim audits.

Nevertheless, sell-side continues to downplay and ignore the risks continued RAC audits represent to the company:

Evidently, sell-side have attempted to assuage investors by making three key arguments:

- The RAC audits are broad-based and were not specifically targeted at Tactile,

- Performant has not requested further claims for review since December 2019, and

- The RAC audits have had no impact on revenue and prescriber activity in the Medicare channel

We believe these arguments are spurious and push back below:

SELL-SIDE COUNTERARGUMENT #1: The RAC audits are broad-based and were not specifically targeted at Tactile

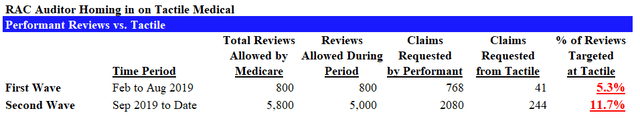

Putting aside the previously mentioned fact (from our June report) that Tactile already represents ~10% of all audits we have data for so far, we believe the evidence actually suggests an increasing focus on Tactile over time.

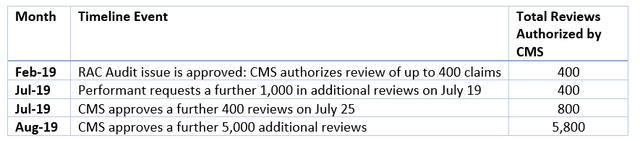

Based on CMS FOIA records as shown below, we were able to put together a basic timeline of the RAC audit process:

Between these two waves (the first 800 up to August 2019, and the next 5,000), the percentage of claims requested from Tactile more than doubled from ~5% to ~12%. We see this as strong evidence that Tactile is being disproportionately targeted. Recall that in the most recent batch of audits, Tactile once again saw an extremely high denial rate of 81%.

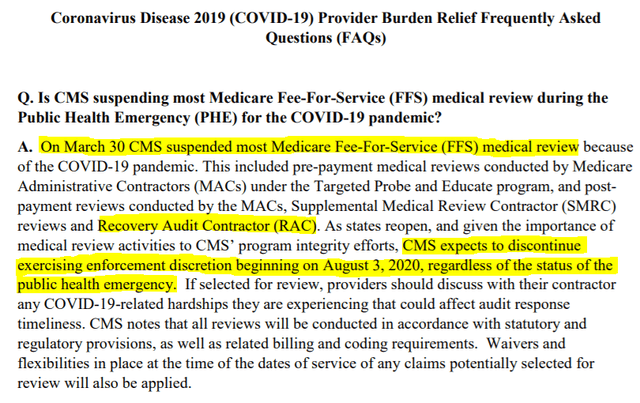

SELL-SIDE COUNTERARGUMENT #2: Performant has not requested further claims for review since December 2019

According to management, Tactile has not received any additional claims requests since December 2019. While true, we believe this argument is misleading: what it ignores is that all Medicare Fee-For-Service (FFS) medical reviews were suspended as of March 30, 2020.

Recall that audit results from Tactile’s third and most recent batch of claims were released in February and March of 2020. In other words, all RAC audits were suspended shortly after the end of Tactile’s third batch of reviews.

We believe the fact that Tactile has not received additional claims requests since December in no way attests to an end in RAC audits. In our opinion, it is purely a symptom of the COVID-19 pandemic.

Notably, CMS authorized the resumption in RAC audit activities on August 3, 2020. We highlight three points:

- Tactile’s most recent batch of audits saw an even greater denial rate of 81% vs. ~70% previously.

- The percentage of reviews targeted at Tactile has increased from 5% to 12% over the last two waves of audits.

- Medicare has authorized 5,800 claim requests, of which Performant has only conducted ~2,800. There are another 3,000 claims to go in the current audit wave alone.

We will let readers come to their own conclusions on the likelihood of further audits on Tactile.

SELL-SIDE COUNTERARGUMENT #3: RAC audits have had no impact on revenue and prescriber activity in the Medicare channel

Empirical evidence suggests this is not true and we believe we have hard data to refute sell-side’s claim. This discussion merits a whole other section on its own—one that addresses a potentially unsettling question. What’s going on with Tactile’s revenue reporting?

CMS FOIA Data Reveal Alarming Discrepancies with Tactile Revenue Reporting

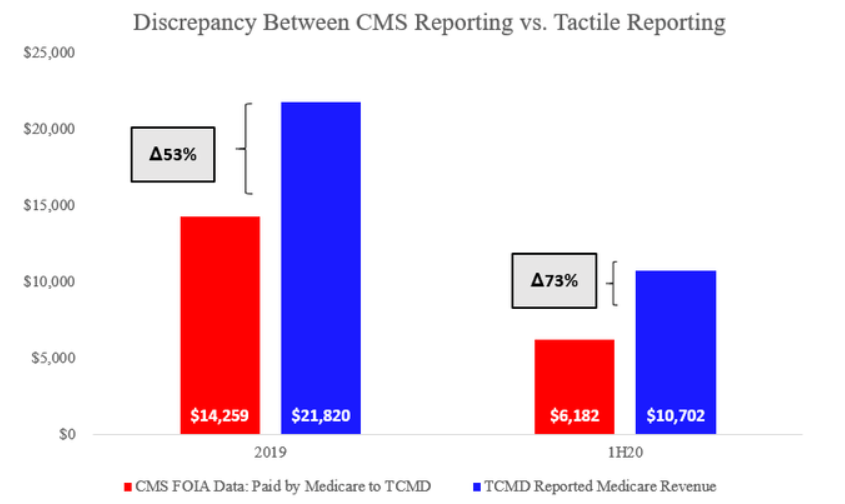

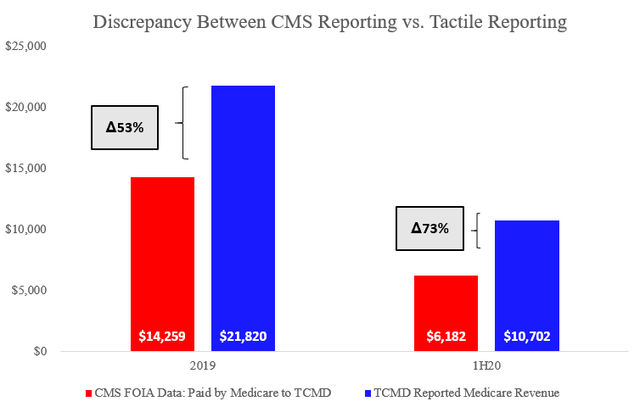

Detailed analysis of Medicare FOIA data and Tactile’s SEC filings revealed the following fact pattern:

- Tactile’s self-reported Medicare revenues are 50 – 70% higher than what Medicare payments data has shown since at least 2019

- During this same period, Tactile’s Medicare days receivable have skyrocketed by nearly 3x

- Also during this same period, Medicare denials of Tactile billing requests for both E0651 and E0652 devices have both seen high-double-digit increases

On their own, ballooning days receivable, increasing denial rates, and a large and growing gap between government data vs. revenue reporting are concerning but possibly explainable. Together, with the RAC audits, we find it potentially alarming.

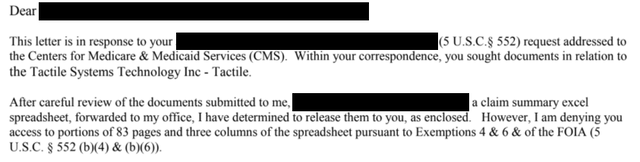

Medicare Data vs. Tactile Reporting

To start with, we received data collected by a CMS FOIA officer that allowed us to compile Medicare payments to and billings by Tactile, by HCPC code. A sample of that data is included below:

We compiled all claims approved by Medicare to Tactile based on the date of service of the devices. Notice that the data includes all codes (E0667 / E0668) and not just E0651 and E0652: we believe this should represent an objective, un-biased measure of Tactile’s Medicare revenue as reported by the US government.

A comparison of this CMS data and Tactile’s reporting presented to investors revealed serious concerns. Tactile’s reported Medicare revenue of ~$22mm in 2019 appears to be overstated by 53% when compared with CMS. This gap further increased to 73% for the first half of 2020.

These are large discrepancies between reporting by the company and the US government. We have sent Tactile investor relations a full copy of our research for feedback and comment but have not received a response regarding these discrepancies.

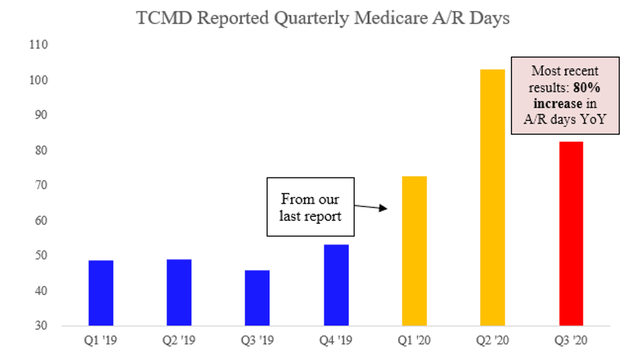

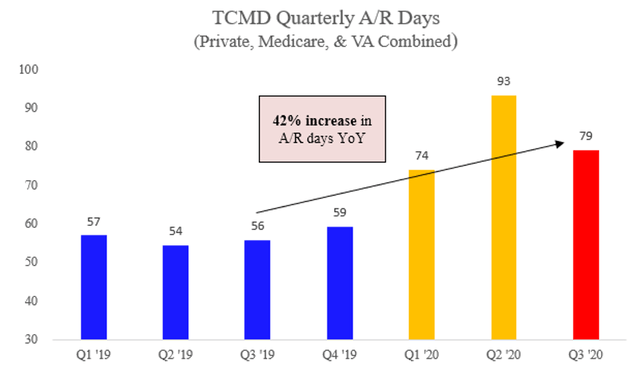

Tactile Medicare A/R vs. Medicare Denial Rates from FOIA

Now consider that since our last report in June, Tactile’s 2Q 2020 results revealed yet another highly concerning increase in Medicare accounts receivable days. Between 1Q and 2Q, Medicare receivable days stretched by over 68%. This was a ~150% increase year on year.

Though surprising at first glance, the increase in A/R days actually fits with what FOIA data suggests is happening behind the scenes. Since the RAC audits began in January 2019, Medicare denials of both E0651 and E0652 devices billed by Tactile have dramatically increased—nearly doubling in the case of E0651’s from March 2019.

(Note that this is different from the RAC audit denial rates: the RAC audit is looking back and denying claims that have already been paid by Medicare. The denial rate here is denying requests submitted by Tactile and a refusal by Medicare to approve the product around the time of prescription. Note also that the data sent to us was through to July 19th, 2020 and the last column may therefore not be reflective of final results.)

Our opinion is that the high denial rates in January and February 2019 may have been a one-time bump driven by the beginning of the RAC audit. We believe this because the RAC audit was announced on January 23, 2019, and Tactile denial rates in January dramatically increased into the back half of the month, largely coinciding with the beginning of the RAC audit:

Moreover, E0652 denial rates show a similarly increasing trend since the RAC audit began:

Recall sell-side was claiming that “management saw no selling impact” from the RAC audits.

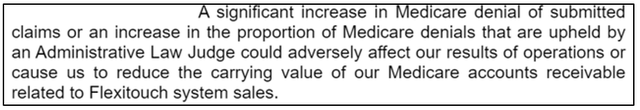

Tactile Risk Disclosure

The final piece of the puzzle comes from Tactile’s own risk disclosure language on this issue:

Instead of writing these receivables down as indicated in the company’s own accounting policy, we believe Tactile has continued to book Medicare revenue while allowing Medicare receivable days to skyrocket. We have sent Tactile investor relations a full copy of our research for feedback and comment but have not received a response regarding the company’s revenue recognition policy.

In fact, based on evidence as presented below, we believe this is potentially a systemic issue that also affects other revenue channels.

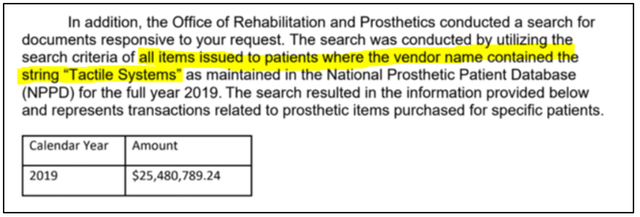

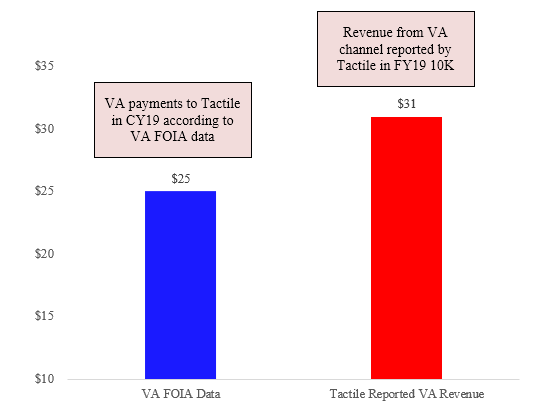

More Revenue Reporting Questions with the VA Channel

Indeed, the discrepancies do not appear to be isolated to just Medicare. A recent FOIA request revealed that during calendar year 2019, the VA spent a total of ~$25.5mm in purchases of products from Tactile:

During this same period, however, Tactile in fact reported ~$31mm in VA revenue, an overstatement of ~22% when compared to VA FOIA data.

Given what appears to be consistent over-reporting of revenue relative to government data, we feel compelled to express concern about the company’s receivables and/or its revenue recognition policies.

This is probably a good time to share one final chart. Total accounts receivable days for the entire company. This is including the private payor channel:

Before readers bring up Covid-19, don’t forget Tactile still grew revenue 16% YoY in 1Q20. And over that same period of time, accounts receivables (EXCLUDING Medicare receivables) grew a whopping 42%.

Concerning Expert Witness Testimony from Qui Tam Lawsuit

As indicated in our last article, a Houston based competitor Veterans First Medical Supply (VFMS) filed a Qui Tam civil suit against Tactile on August 20, 2018. Qui Tam suits are filed on behalf of the US Attorney General and represents a legal route for whistleblowers in the healthcare industry. Central to the lawsuit is the allegations of Tactile’s use of unlawful financial incentives and marketing practices to induce sales and share gains.

The full complaint as well as the source documents for our discussion below can be obtained by visiting the following website: Public Access to Court Electronic Records | PACER: Federal Court Records. You will need to look up the case number (4:18-cv-02871) under the PACER Case Locator.

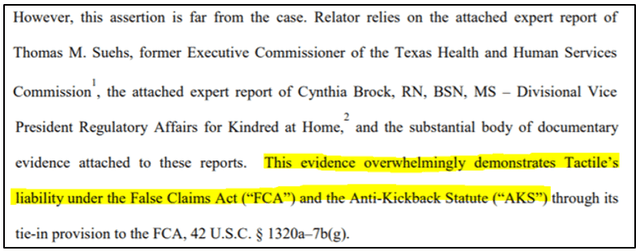

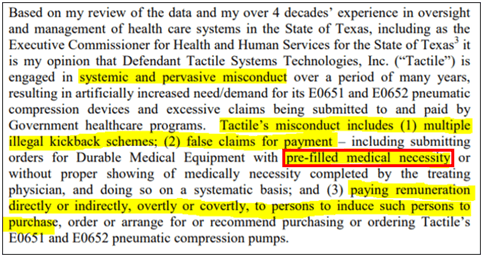

On September 29, 2020, the relator in the Qui Tam lawsuit filed against Tactile released a new brief that included alarming testimony from two key expert witnesses, Thomas M. Suehs, former Executive Commissioner of the Texas Health and Human Services Commission, and Cynthia Brock, Divisional VP of of Regulatory Affairs for Kindred at Home.

In fact, testimony from both experts strongly corroborates what we have discussed in our current and previous reports: 1) an indirect sales and marketing strategy that experts believe to be in violation of the Anti-kickback Statute, and 2) serious issues surrounding medical necessity for Tactile pump prescriptions as backed by the RAC audit results.

While many of the underlying evidence documents remain under seal, we believe what has surfaced in this brief is already concerning. Let’s start with the statement from Thomas Suehs, the former Executive Commissioner:

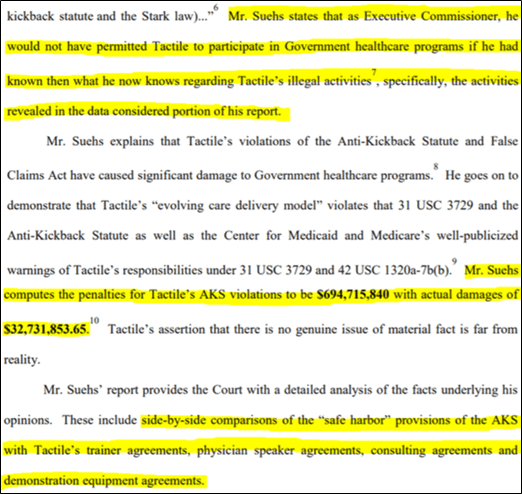

In fact, Mr. Suehs calculates penalties for Tactile’s AKS violations to be nearly ~$700mm. More importantly, his testimony is apparently backed by detailed analysis of Tactile’s trainer agreements, consulting arrangements, and more:

Equally, the expert report of Cynthia Brock testifies to a similar opinion:

We believe this following section from Mrs. Brock’s statement is even more important:

While industry participants we spoke to have brought up Tactile’s clinician remuneration activity before (see our first article), these Form-1099s appear to represent concrete evidence of this conduct. The fact these forms are mentioned here is revealing. If the relator is able to establish links between training compensation and prescriptions, we believe this would be a crucial piece of evidence for the case.

“Pre-Filled Medical Necessity Verbiage”

Note we have yet to discuss the text we emphasized with red boxes—the expert opinion relating to Tactile’s use of pre-filled medical necessity and prescription.

What is a pre-filled prescription in this context? Given the rigorous reimbursement and medical necessity criteria in reimbursing E0652 devices, doctors need to diagnose and then document patient progress through multiple first-line treatments (if they work, E0652 is not needed) before filling out a prescription request for the device. A pre-filled prescription is when a sales rep or distributor fills these documents out for the doctor.

Think of it this way: the salesperson marketing the device is telling/giving the doctor what to diagnose and prescribe a patient. The conflict of interest issues here should be self-evident: manufacturer and distributor sales staff have clear incentives to drive more prescriptions and therefore revenue for their devices, sometimes at the expense of patient treatment (and of course taxpayers).

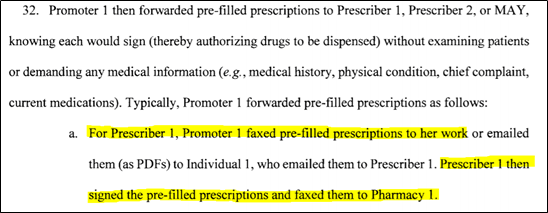

Unsurprisingly, pre-filling prescriptions is illegal. If you’re still not convinced, just look at this recent indictment from the US Dept. of Justice for a case being investigated by the FBI and OIG HHS in Arkansas. This is an issue prosecutors and regulators take seriously. Note this is merely an example to demonstrate the legality and seriousness of these issues. We are in no way suggesting any affiliation between Tactile and the events or individuals covered in the indictment.

Since that’s established, this next discussion is so important it deserves its own section:

Potentially Systemic Use of Pre-Filled Prescriptions at Tactile

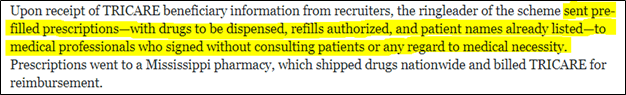

We were recently connected with a reputable industry insider who works closely with lymphedema patients, distributors, and manufacturers. For the last several years, this individual has been at the receiving end of mass communications sent by Tactile via non-digital means.

These documents were addressed to and/or intended for clinics or physicians in the individual’s wider territory. This source believes these documents were sent to him/her erroneously. We believe these documents provide strong evidence suggesting systemic misconduct at the hands of Tactile employee in providing pre-filled prescriptions and pre-written medical necessity letters to physicians.

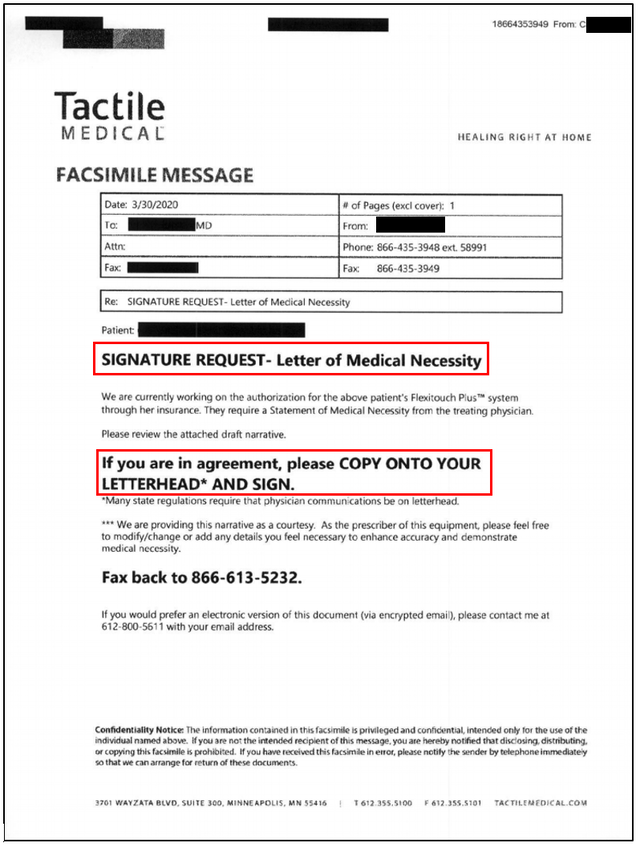

A partial list including multiple examples of these documents was shared with us and a few are shown below personal information redacted by the source. We have further redacted the full names of Tactile employees in these documents out of respect for their privacy, leaving only their first initials visible. We present a few samples below to facilitate discussion and to highlight the critical legal and regulatory risks that these documents represent for both Tactile and the physicians.

One set of these documents starts with a cover letter specifically requesting for a physician’s signature and asking the clinic to “Copy and Paste” a “draft narrative” onto company letterhead. Note the first initial at the top right-hand corner—an individual whose name we have redacted but can confirm is a Tactile employee (in this case, a “Sales Support Representative”, others we have found are “Order Intake Coordinators”). To reiterate, we believe this fax was intended to be sent to a physician whose name has also been redacted.

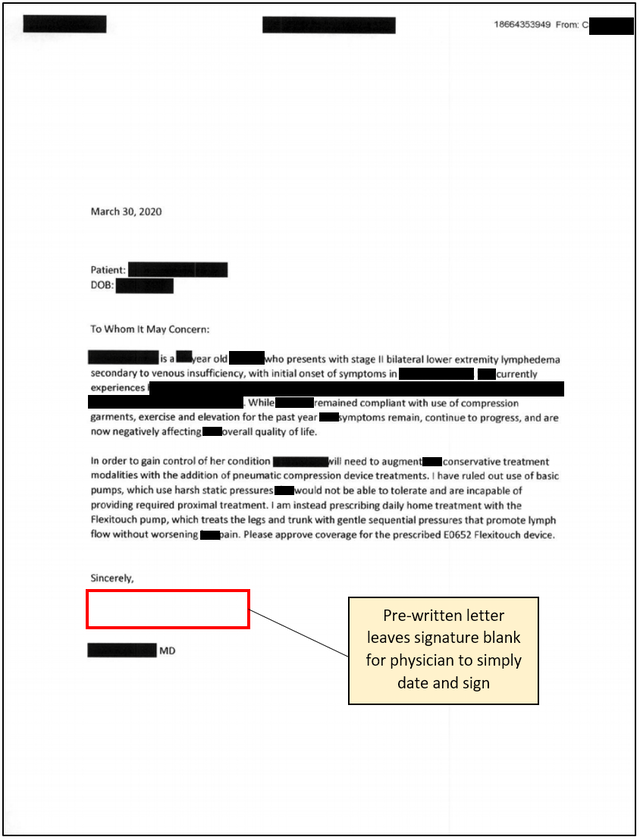

The second page of that same fax shows this “draft narrative”—a pre-written letter on the patient’s medical history, symptoms, and the medical necessity / rationale for prescribing the Flexitouch pump. Note the empty space left in for the physician’s signature. Recall from the cover letter that this document was faxed to a physician with the express purpose of requesting the doctor’s signature on this letter pre-written by Tactile staff.

Note also that the date and first initial both correspond with the cover letter.

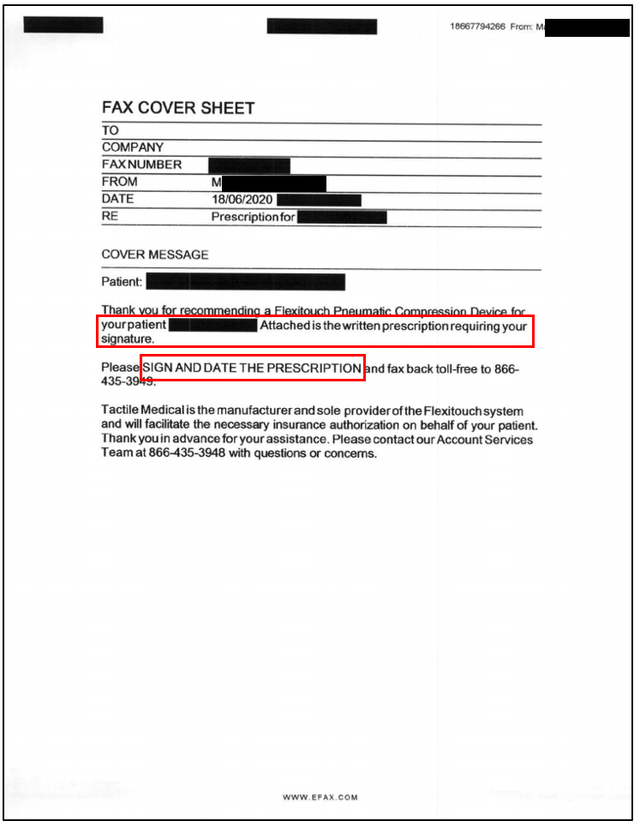

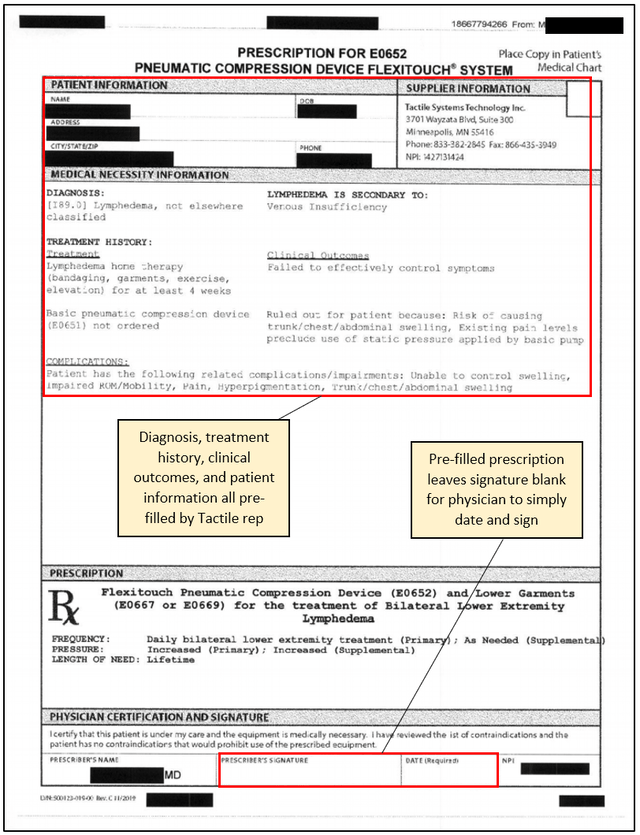

It actually gets even worse. The next document is yet another cover letter faxed from a Tactile employee and intended for a physician (name redacted). This time, however, it precedes an actual prescription order for a Flexitouch device that is already filled out (pre-filled, one might say) by a Tactile employee—the only thing empty is the signature box for the physician. The cover letter itself even directly asks for the physician’s signature, in all caps no less.

As mentioned, the cover letter above came attached with this prefilled prescription as shown below. Notice again that the data and first initial of the Tactile rep match in both documents.

Included below is a snippet from the full indictment for the pre-filled prescription case in Arkansas:

Sound familiar?

To be clear, we fully acknowledge that we do not prove from these documents alone that the physicians in these cases are not properly examining or reviewing the patients. In fact, it might be perfectly reasonable to speculate that these practices were put into place for the sake of prescriber convenience and time-efficiency. Presumably, prescribers are also free to modify or disregard these documents if they so choose.

However, we ask readers to put this in context with the 70%+ denial rates from the RAC audits—all of which related to medical necessity denials—to illustrate this may be a systemic problem with serious risk to investors.

Consider again this snippet from the US DoJ website detailing its Arkansas pre-filled prescription indictment:

(Again, note this is an example to demonstrate the legality and seriousness of these issues. We are in no way suggesting any affiliation between Tactile and the events or individuals covered in the Arkansas indictment.)

Now consider the fact pattern we have shown both in our current and previous report:

- As demonstrated above, Tactile employees appear to be pre-filling prescriptions that are sent to doctors for signature. Device, patient name, symptoms, and medical necessity are all already listed.

- Citing medical necessity, the RAC auditor Performant has denied over 70% of all Tactile Medicare claims audited so far.

To take this one step further, we also wanted to illustrate just how similar the language is across all the different pre-filled or pre-written documents being faxed from Tactile employees. Each of the boxes below is taken from a different medical necessity letter for different patients. Color-coding is added by us to demonstrate just how similar the language Tactile employees appear to be using across multiple documents and patients. Full copies of these documents can be found in the appendix to the PDF.

Given the range of dates and different employees involved, we believe these practices are system and not one-time, one-off, or individual bad apples. In the documents included within the appendix alone, nine different Tactile employees show up.

We do also want to acknowledge the issue of credibility here. While we are highly confident in the source and the preservation / validity of these documents, readers may express doubts about their veracity. Understandable.

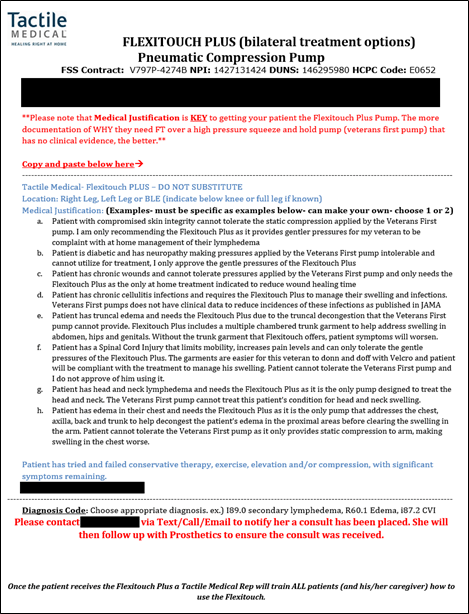

Since we want to respect our source’s wish to remain anonymous, we can point you to something else: a medical justification template sent by a Tactile rep to doctors at the Dallas VA hospital we received via FOIA request.

Though less direct than pre-filled prescriptions, the similarities in language (“Flexitouch Plus… provides gentler pressures”, “…cannot tolerate the static compression…”) and intent (“Copy and paste below here”) are hard to ignore. Readers looking to obtain these records for themselves should request email correspondence between Tactile employees and the Dallas VA hospital via FOIA.

We have sent Tactile investor relations a full copy of our research for feedback and comment but have not received a response regarding the apparent use of pre-filled prescriptions at the company.

Prescriber Concentration: More Questions on Tactile’s Sales and Marketing Activity

In mid-2018, Tracy Sempowich, the former regional manager of Tactile’s Mid-Atlantic region, filed a lawsuit alleging employment related gender discrimination. The case can be found on Pacer under 5:18-cv-00488-D.

The most concerning items for us were the company’s sales account data released during the discovery process.

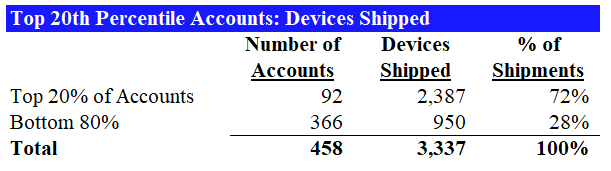

It turns out that as of 2017, more than 70% of all Flexitouch devices shipped came from only 20% of clinics. Conversations with former and current executives at large national insurers revealed that prescriber concentration is a key indicator that investigators look for in uncovering potential problems. We walk through our findings below.

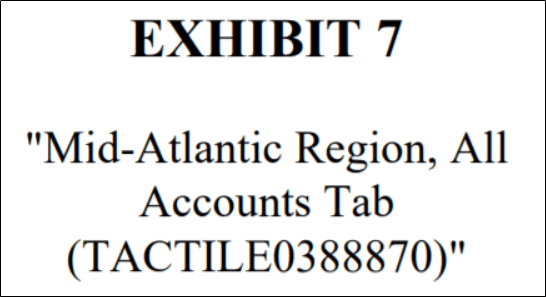

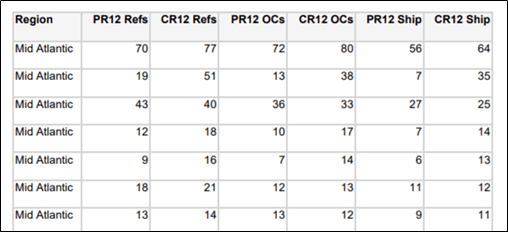

The order and shipment data by sales account (e.g. prescriber, clinic, etc.) for the Mid-Atlantic sales region was released under Exhibit 7 of a recent discovery document filed on Pacer:

The data includes ~20 pages totaling 458 accounts that shipped one or more Tactile devices in the Mid-Atlantic region during 2017. A sample is provided below. We believe each row refers to an account while ‘CR12 Ship’ refers to devices shipped in the then-current period (2017) for that account.

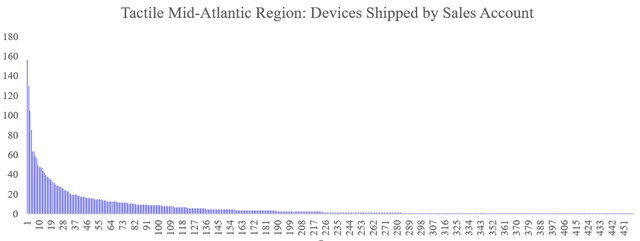

Charting the results (Y: devices shipped by X: sales account) revealed a shockingly skewed and top-heavy prescriber base:

In fact, we discovered that Tactile’s top 20% prescribers accounted for nearly 75% of prescriptions:

We have sent Tactile investor relations a full copy of our research for feedback and comment but have not received a response regarding the high prescriber concentration levels at the company.

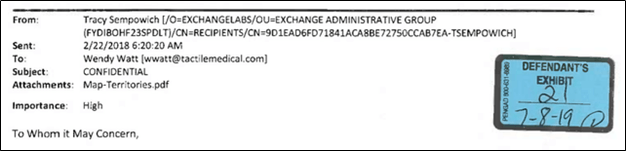

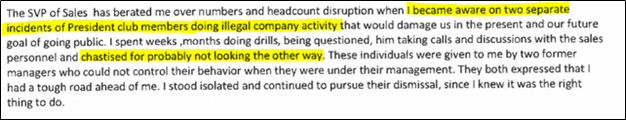

More still, buried in the lawsuit was yet another new reference to potential misbehavior at the hands of sales staff at Tactile. The excerpt below is taken directly from an email sent by the plaintiff, Tracy Sempowich, in February 2018 to Tactile’s then HR manager Wendy Watt:

We find all of this to be highly troubling for investors of the company. Between the RAC audits, whistleblower lawsuit, Mrs. Sempowich’s allegations above, prescription documents, and the clear evidence of exorbitant prescriber concentration… all roads seem to be leading to Rome.

Rapidly Emerging Competition

Last but not least, we believe the market may not fully grasp the sheer extent to which competition is intensifying in the PCD industry.

While the distributor side has always been highly fragmented, PCD manufacturing has historically been dominated by a handful of key players: Tactile Systems, Bio Compressions, Lympha Press, and 2018 entrant NormaTec.

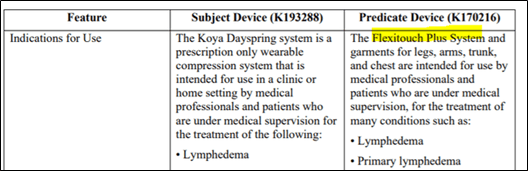

Since December 2019, five new entrants have received 510(K) approval for PCD devices – at least two of which were specifically approved using Tactile devices as the predicate product to establish equivalency.

These new competitors are shown below from the FDA website:

We highlight a few in particular:

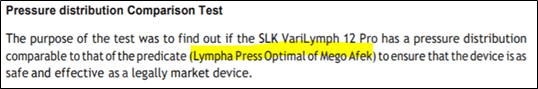

| VariLymph 12 Pro (August 2020 Approval) Product Website and Description: link Developed by German medtech manufacturer SLK Medical GMBH. Varilymph is notable given the company’s high market share and strong presence in the European lymphedema treatment market. Note that Germany is widely recognized as being at the cutting edge of lymphedema treatment and expertise. Varilymph’s launch in the US will be backed by publicly listed Apex Medical from Taiwan. Apex has existing distribution into wound therapy clinics that have strong overlap with PCD.  https://www.accessdata.fda.gov/cdrh_docs/pdf19/K193476.pdf https://www.accessdata.fda.gov/cdrh_docs/pdf19/K193476.pdfVarilymph was approved against Lympha Press as the predicate device. Lympha Press is one of Tactile’s largest competitors for the Flexitouch product. |

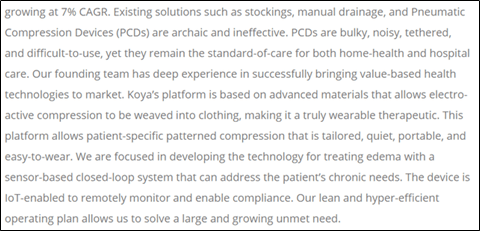

Koya Ripple (June 2020 Approval) Source: link Venture-backed (UCSF Rosenman Institute) new entrant based out of San Francisco. Koya is taking traditional PCD technology and developing a portable, connected version that will be portable. The device will connect to a cloud application that will then allow physicians and therapists to interact with care via usage data and develop personalized treatment plans. The Koya device received 510(K) approval going head to head against the Flexitouch Plus as its predicate device:  Source: https://www.accessdata.fda.gov/cdrh_docs/pdf19/K193288.pdf Legacy PCD technology like Tactile’s have been around since the 1980s and ripe for disruption: here’s what Tactile’s patients look like when using their devices. |

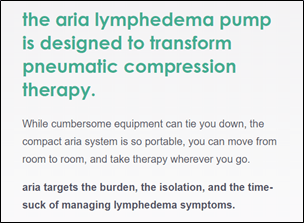

Aria Pump (April 2020) Source: https://aria-therapy.com/meet-aria/ The Aria system is being launched by InovaLabs, an internal spin out from publicly traded ResMed. The Aria device was approved against the Tactile Entre as its predicate device. Like Koya, the Aria pump looks to iterate upon legacy technology by adding portability and connectivity features. |

Medi USA (January 2019 Approval) Though not highlighted in our earlier table, we note that Medi launched a competing PCD device, receiving 510(K) approval in January 2019. Conversations with industry contacts suggest they are slow-playing commercial launch in order to avoid reimbursement issues like Tactile.Note in particular that Medi is an industry giant in traditional compression garments with an extremely strong presence across all call points for lymphedema treatment and diagnosis. |

Over the next few months, we believe the PCD industry will transform from a three-player oligopoly to a highly competitive field contested by at least nine well-capitalized competitors.

We believe many of these recent new entrants are in a strong position to take share from Tactile – especially in light of Tactile’s issues with its whistleblower lawsuit and Medicare audits.

Conclusion

Instead of being a high-growth, disruptive player with a large and growing TAM, we think Tactile is fighting for a smaller share in a shrinking pie – all while fighting off numerous regulatory and legal disruptions as a result of the company’s marketing practices. Auditors, regulators, and competitors appear to be closing in. We believe investors should think twice before investing in Tactile.